Navigating the world of investments can feel overwhelming, but with the right knowledge and a strategic approach, you can build a secure financial future. Whether you’re a seasoned investor or just starting out, understanding key investment principles is crucial for making informed decisions and achieving your financial goals. This guide provides practical investment tips to help you grow your wealth effectively.

Understanding Your Investment Goals and Risk Tolerance

Defining Your Financial Objectives

Before diving into the stock market or any other investment, it’s vital to clearly define your financial objectives. Ask yourself:

- What are you saving for? (e.g., retirement, a down payment on a house, children’s education)

- What is your investment timeline? (Short-term, medium-term, long-term)

- How much capital do you need to achieve your goals?

For example, if you’re saving for retirement in 30 years, you can afford to take on more risk compared to someone saving for a down payment in 5 years. Having well-defined goals will guide your investment choices.

Assessing Your Risk Tolerance

Risk tolerance refers to your comfort level with the potential for investment losses. Understanding your risk tolerance is crucial for choosing suitable investments. Here’s how to assess it:

- Consider your personality: Are you comfortable with uncertainty, or do you prefer stability?

- Evaluate your financial situation: How easily could you recover from a significant investment loss?

- Reflect on past experiences: How did you react to market downturns in the past?

A conservative investor might prefer lower-risk investments like bonds or certificates of deposit (CDs), while an aggressive investor might be comfortable with higher-risk investments like stocks or real estate. Tools like risk tolerance questionnaires, readily available online from various financial institutions, can provide helpful insights.

Diversifying Your Investment Portfolio

The Power of Asset Allocation

Diversification is a risk management strategy that involves spreading your investments across different asset classes. This reduces the impact of any single investment performing poorly. Common asset classes include:

- Stocks: Represent ownership in companies and offer the potential for high growth, but also carry higher risk.

- Bonds: Represent loans to governments or corporations and generally offer lower risk and lower returns than stocks.

- Real Estate: Can provide income through rental properties and appreciation in value.

- Commodities: Raw materials like gold, oil, and agricultural products.

The right asset allocation will vary based on your risk tolerance and investment goals. For instance, a younger investor with a long time horizon might allocate a larger portion of their portfolio to stocks, while an older investor nearing retirement might allocate more to bonds.

Examples of Diversification Strategies

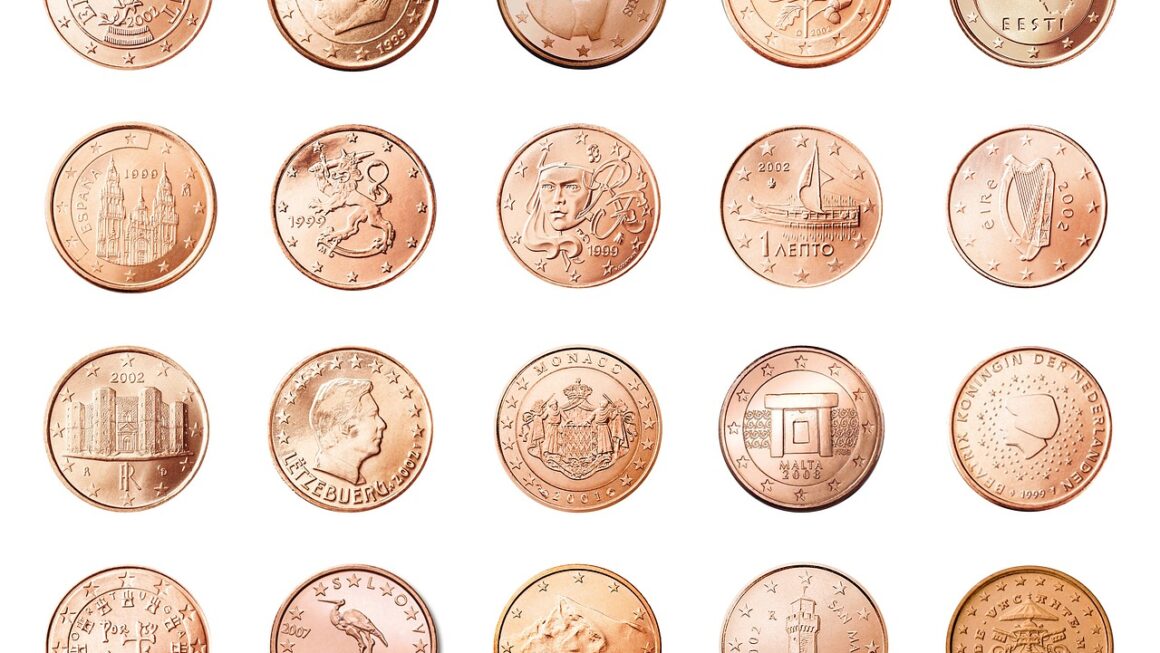

- Geographic Diversification: Investing in companies from different countries to mitigate country-specific risks.

- Sector Diversification: Investing in companies from various industries (e.g., technology, healthcare, energy) to avoid over-exposure to a single sector.

- Investment Vehicle Diversification: Utilizing mutual funds, exchange-traded funds (ETFs), and individual securities.

For example, instead of only investing in technology stocks, consider also investing in healthcare, consumer staples, and energy stocks. A simple way to achieve this is by investing in a broad market ETF that tracks the S&P 500 or a total stock market index.

Investing in Stocks: A Foundation for Growth

Understanding Different Types of Stocks

Investing in stocks can be a powerful way to grow your wealth over time. However, it’s important to understand the different types of stocks available:

- Large-Cap Stocks: Stocks of large, well-established companies with a market capitalization of $10 billion or more. They tend to be less volatile than smaller stocks.

- Mid-Cap Stocks: Stocks of medium-sized companies with a market capitalization between $2 billion and $10 billion. They offer a balance between growth potential and risk.

- Small-Cap Stocks: Stocks of small companies with a market capitalization between $300 million and $2 billion. They have the potential for high growth, but also carry higher risk.

- Growth Stocks: Stocks of companies that are expected to grow at a faster rate than the average company.

- Value Stocks: Stocks of companies that are undervalued by the market and trade at a lower price relative to their earnings or book value.

Fundamental Analysis: Picking Winning Stocks

Fundamental analysis involves evaluating a company’s financial health and growth potential to determine its intrinsic value. Key metrics to consider include:

- Earnings per Share (EPS): A measure of a company’s profitability.

- Price-to-Earnings (P/E) Ratio: A comparison of a company’s stock price to its earnings per share.

- Debt-to-Equity Ratio: A measure of a company’s financial leverage.

- Return on Equity (ROE): A measure of a company’s profitability relative to its shareholders’ equity.

Analyzing a company’s financial statements, reading industry reports, and staying informed about economic trends can help you make informed stock-picking decisions. For example, a company with consistently growing EPS, a low P/E ratio compared to its peers, and a healthy ROE might be a good investment.

Bonds: A Stabilizing Force in Your Portfolio

Understanding Bond Basics

Bonds are fixed-income securities that represent a loan made by an investor to a borrower (typically a government or corporation). In return, the borrower promises to pay the investor a specified interest rate (coupon) over a specified period (maturity). Key features of bonds include:

- Credit Rating: A measure of the borrower’s creditworthiness, with higher ratings indicating lower risk.

- Yield: The return an investor can expect to receive from a bond, taking into account its price and coupon rate.

- Maturity Date: The date on which the borrower repays the principal amount of the bond.

Types of Bonds

- Government Bonds: Issued by national governments and are generally considered to be very safe.

- Corporate Bonds: Issued by corporations and offer higher yields than government bonds, but also carry higher risk.

- Municipal Bonds: Issued by state and local governments and are often tax-exempt.

Bonds can provide stability to your portfolio by generating income and acting as a buffer during market downturns. For instance, during periods of stock market volatility, investors often flock to bonds, driving up their prices and providing a hedge against losses in the stock market.

Rebalancing Your Portfolio Regularly

Why Rebalancing is Important

Over time, your portfolio’s asset allocation will drift away from your target allocation due to market fluctuations. Rebalancing involves selling some assets that have performed well and buying assets that have underperformed to bring your portfolio back to its original target.

- Maintain Your Risk Profile: Rebalancing helps you stay within your desired risk tolerance level.

- Take Profits: It allows you to sell high and buy low, potentially improving your long-term returns.

- Stay on Track: It ensures that your portfolio remains aligned with your financial goals.

How to Rebalance

- Set a Rebalancing Schedule: Rebalance your portfolio at regular intervals, such as annually or semi-annually.

- Establish Tolerance Bands: Allow your asset allocation to deviate within a certain range (e.g., +/- 5%) before rebalancing.

- Consider Tax Implications: Be mindful of capital gains taxes when selling assets.

For example, if your target allocation is 60% stocks and 40% bonds, and your portfolio has drifted to 70% stocks and 30% bonds due to stock market gains, you would sell some stocks and buy bonds to bring your portfolio back to the 60/40 allocation.

Conclusion

Investing wisely is a journey, not a sprint. By understanding your goals, diversifying your portfolio, and staying disciplined, you can build a solid foundation for long-term financial success. Remember to regularly review and adjust your investment strategy as your circumstances change. Always seek professional advice from a qualified financial advisor if you have complex financial needs or require personalized guidance. With the right approach and a commitment to continuous learning, you can confidently navigate the world of investments and achieve your financial aspirations.